Can I Keep My Ex Wife on My Car Insurance

The dissolution of a marriage can be a stressful ordeal, especially when splitting assets and fighting over who gets the house and who pays the alimony.

Can I remove my spouse from my car insurance policy?

The answer is yes, you can remove your spouse, or any other family member on a shared plan, from your car insurance policy. You'll need to send a removal request form to your car insurance provider to have your spouse removed. Your spouse will then have to provide written consent for their removal. If you are the person who is being removed from the car insurance plan, you should have another policy lined up to start right after your prior plan is terminated. That way, you'll ensure there are no lapses in your insurance coverage.

While sorting through your family's car insurance is probably the last thing on your mind, it's a good idea to get a head start and separate your policies.

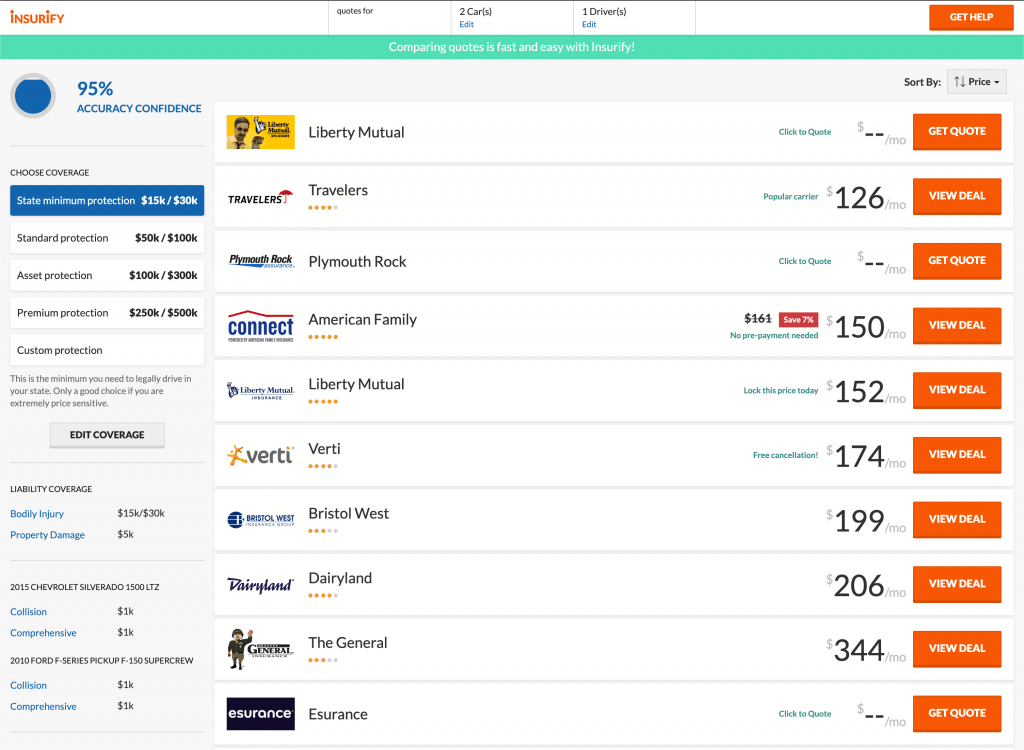

(And although finding a new insurance policy can be difficult, you can always useInsurify to find and compare car insurance quotes.)

If you're doing a trial separation

Suppose you and your spouse decide to do a trial separation where one of you moves out of the house. In this case, you'll have to contact your current insurance carrier and update them with the vehicle's new garage address and your new commute distance.

If you've decided to get a divorce

If you and your partner decide to get a divorce, you will have to begin the process of separating your car insurance policies. While doing so, consider the following:

- Either you or your ex-spouse has to get a new policy: This could depend on several factors, but it might be easier for the policyholder to apply for the removal of the primary insured person (the person listed on the policy, also known as the PNI, or primary named insured). The person being removed is legally required to give written consent. If you're the person who is being removed from the policy, you should have another policy lined up to start right before your current policy ends to ensure there are no lapses in your insurance coverage.

- Premiums change depending on where you move: If one of you is moving to another city or state, you might have to consider factors that could impact your insurance premium. Usually, bigger cities have higher crime rates that increase the risk of auto theft and damage, which could increase your premium. Moving to a rural area will typically have the opposite effect. In the same way, if the area you're moving to is more prone to natural disasters than where you were living before, you may have to pay slightly higher. States also have different insurance requirements for minimum coverage, which you'll also have to keep in mind when shopping for a new policy. Use an insurance comparison website likeInsurify to make sure your new policy fits your needs and budget while satisfying minimum state requirements.

- Make sure your name is on your vehicle title:You need to be on the title of the vehicle you're insuring. So before removing your ex-spouse or yourself from your auto insurance policy, make sure only your name is on the title of the vehicle you intend to drive.

Buying a new car insurance policy

Usually, car insurance companies give discounts to married couples or offer one for multi-car discounts if you and your partner insure your cars under a joint car insurance policy. So chances are you might have to pay higher insurance rates after the divorce with a separate car insurance plan. Then again, if your spouse had a poor driving record with multiple DUIs or at-fault car accidents, while your driving history was mostly clean, you may get to pay less than you did before.

We ran insurance quotes on Insurify, which gives you free quotes for your profile, for a sample driver. The quotes are for a 40-year-old female in St. Augustine, Florida, who drives a 2016 Honda Accord and recently got a divorce. Below are the quotes from when she applied for car insurance with her partner and when she applied by herself after their divorce.

| Insurance Company | "Married" Quote (Two drivers) | "Divorced" Quote (One driver) | Percent Change |

|---|---|---|---|

| Travelers | $138/month | $89/month | -35.5% |

| Elephant | $130/month | $102/month | -21.5% |

| SafeAuto | $170/month | $113/month | -33.5% |

| National General | $178/month | $121/month | -32% |

| Direct Auto | $190/month | $134/month | -29.5% |

| GAINSCO | $195/month | $136/month | -30.3% |

| Mercury | $263/month | $140/month | -46.8% |

| Bristol West | $56/month | $158/month | +182% |

| The General | $221/month | $161/month | -27% |

| Dairyland | $247/month | $185/month | -25% |

Whether you're the person staying on the existing policy, or you're the person who's being removed, you should shop around for a new policy and make sure you're getting all the discounts for which you're eligible. Keep in mind the following when you're buying your new car insurance policy:

- Your new insurance rate will reflect only your driving record: Since both you and your former spouse will now have separate coverage, your new insurance rate will reflect only your driving history and the car you own. So if you're keeping the station wagon and your ex-spouse is taking the sports car, you might have to pay lower rates than them. In most states, except Hawaii, California, and Massachusetts, insurance companies also consider your credit history when calculating your quotes. If your credit score is better than your former spouse's, you may get a lower deal.

- You could get a discount if you bundle your insurance policies:Insurance companies usually give out discounts when you bundle your auto insurance along with any other insurance policies you need, such as renters insurance or homeowners insurance. Whether you're staying in the home you and your former partner shared, or you're the one who's moving out, it makes sense to bundle your home insurance with your auto insurance. You can do so onInsurify, a virtual insurance agency where you can compare free quotes for your insurance needs with Insurify insurance agents and find out what discounts for which you may be eligible.

- You should add your driving-age kids to your insurance policy: If you and your ex-spouse have driving-age kids, they will need to be on either you or your ex-spouse's insurance, since premiums for independent teen drivers are much more expensive. You should add your child to the insurance policy that covers the car they drive. If your child drives both you and your ex-spouse's cars, add them to both insurance policies.

Divorce can get messy, and you might not have the time and energy to sort through the specifics of separate policies. Nevertheless, it's important to separate your insurance from that of your former spouse and make sure that your own policy no longer holds you liable for their driving record.

What does car insurance cost for single vs. married drivers?

Because insurance companies typically consider married drivers to be slightly less risky to insure than single ones, there are differences in the average cost of car insurance between spouses and singletons. Insurify used proprietary data to analyze the differences in average premium costs between married and single drivers by U.S. in the two maps below.

Average Cost of Car Insurance for single drivers

Average monthly cost of car insurance for married drivers

What are the three best car insurance companies for single drivers? Amigo USA, Metromile, and Farmers come in first, with average monthly quotes of $102, $108, and $109, respectively.

For married drivers, Amigo USA and Metromile still provide affordable average monthly premiums, but Clearcover also cracks the top three providers, charging an average of $121 monthly.

Shopping around for a new policy can seem like a daunting, time-consuming task, but it doesn't have to be. UseInsurify to find and compare the best and cheapest insurance quotes from the biggest number of insurers, whether you're actively due for a new plan or just curious about ways to save. It's fast, easy, and secure!

FAQ: Removing Your Spouse From Your Car Insurance

Can I remove my spouse from my car insurance?

Yes. All car insurance companies should offer an option for policyholders to remove a secondary member from their insurance plan, whether that's a spouse or a child.

How can I remove someone from my car insurance plan?

To remove someone from your car insurance plan, you'll need to be the primary named insured, or PNI, for your policy. Then, you'll need to apply to your car insurance provider to have the person in question removed from your plan. They will need to provide written consent acknowledging this removal.

How can I save on my car insurance costs after a divorce?

Because car insurance companies often charge lower rates to married couples, you may see your premiums rise after a divorce. The best way to save on car insurance costs after a divorce is to use a quote-comparison site like Insurify. Insurify allows customers to see dozens of quotes from the nation's leading insurance companies, and customers save an average of $585 per year.

Score savings on car insurance with Insurify

Updated July 19, 2021

Tanveen Vohra is currently a content writer for Insurify. Tanveen has a background in college media, having produced videos, news articles, and feature pieces for various student magazines and newspapers at SUNY Buffalo. She recently moved to the Boston area, and now works full-time for Insurify, helping produce blog content. In her spare time she frequents climbing gyms and explores film photography.

Can I Keep My Ex Wife on My Car Insurance

Source: https://insurify.com/blog/car-insurance/car-insurance-after-divorce/